Hey guys Nick here from Knicks Taxes today we're going to talk about the new home office deductions that Canada has recently just put in place for the 2020 tax year back in the fall economic update Canada announced that Canadians are going to be able to claim up to 400 in home office expenses for those Canadians who had to work from home due to the pandemic so today December 15th Canada has just released more information as to whose going to be eligible for these expenses and how we can claim these expenses on our 2020 tax return so in today's video we're going to walk through whose going to be eligible and how we can claim it so that way you can claim this home office deduction on your 2020 tax return, but before we jump into the content if you're new to the channel hi what's going on I'm nick I make personal tax and finance videos as well as some investing videos on a regular basis I try to keep you guys as updated as possible when it comes to Canadian tax matters so if that's of interest to you please consider subscribing also if you get value out of this video please give it a thumbs up it helps my channel grow, and it gets this video out there to more people who find this kind of stuff useful so especially if you're watching this video, and you're looking at doing your 2020 taxes you're going to want to be aware of this home office expense if you've been working from home due to the pandemic now to give you guys a little of a background before the pandemic started often times people who worked from home had an agreement with their employer where...

PDF editing your way

Complete or edit your t2200 tax form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export cra declaration of employemnt directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your t2200 form pdf as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your cra t2200 form pdf by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Canada T2200 2019-2025 Form

About Canada T2200 2025 Form

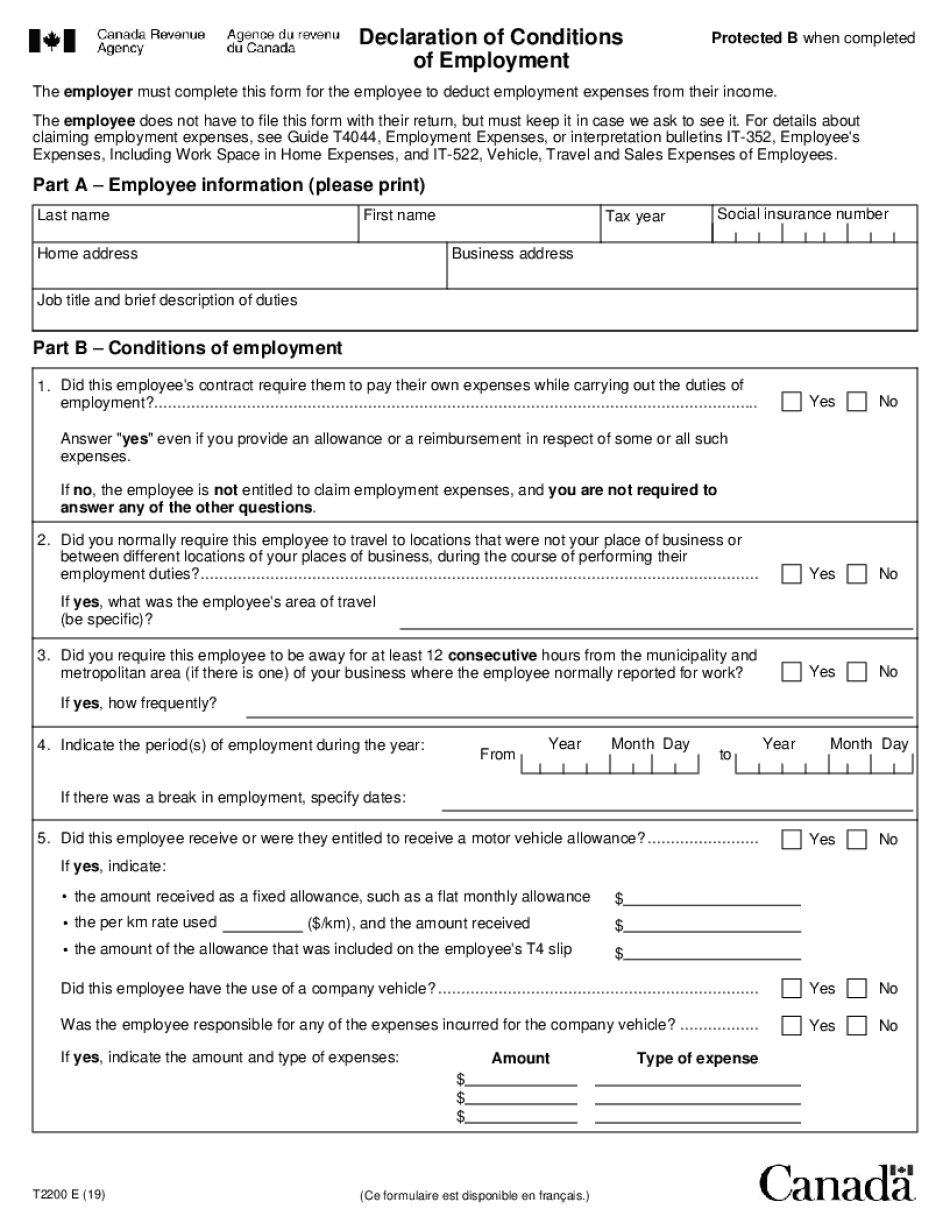

The Canada T2200 2025 form, also known as the Declaration of Conditions of Employment, is a tax form used in Canada. It is required for employees who want to claim employment expenses as deductions on their personal income tax return. The T2200 form is typically provided by an employer to their employee, indicating that the employee must incur certain expenses in order to carry out their employment duties. By completing this form, the employee is certifying that they meet the specific conditions set by the Canada Revenue Agency (CRA) to claim deductions for expenses such as vehicle expenses, home office expenses, supplies, and other work-related costs. To qualify for claiming employment expenses, the employee must meet the following criteria: 1. The expenses must be directly related to their employment duties and required by their employer. 2. The employee is required to pay for the expenses themselves, without any reimbursement from the employer. 3. The expenses were not already reimbursed through a non-taxable allowance. 4. The employee was not provided with any form of non-taxable benefit. It is important to note that not all employees are eligible to claim employment expenses, as it is specific to certain professions and job requirements. Additionally, the T2200 form may require additional supporting documentation and must be filed by the employee with their personal income tax return. Consulting with a tax professional or referring to the CRA's guidelines can provide more specific information on who precisely needs to complete the T2200 form and what expenses are eligible for claim.

Online alternatives help you to coordinate your report administration as well as improve the productivity of the work-flow. Stick to the fast guidebook in order to complete Canada T2200 2025 T2200 Form, prevent mistakes along with furnish it regularly:

How to perform a Canada T2200 2025 T2200 Form on the internet:

- On the site using the PDF, just click Begin right now as well as move on the writer.

- Use the particular hints in order to fill in the kind of career fields.

- Type in your personal details and speak to info.

- Make certain one enters appropriate details and also amounts within proper fields.

- Carefully look into the articles with the file along with sentence structure and transliteration.

- Go to Assistance area when you have questions as well as tackle each of our Support staff.

- Place a digital trademark on your own Canada T2200 2025 T2200 Form with the help of Sign Instrument.

- As soon as the form is finished, media Accomplished.

- Send the actual set PDF by way of electronic mail or perhaps fax, produce it or save money on your current system.

PDF manager lets you help to make modifications in your Canada T2200 2025 T2200 Form on the web connected device, personalize it based on your needs, indication this electronically along with disperse differently.

What people say about us

Digitally preparing forms in the new world of remote work

Video instructions and help with filling out and completing Canada T2200 2019-2025 Form